Discover how to enhance your movie-watching experience with greater peace of mind by opting for secure Qatar travel!

The Middle East nation combines technology with Muslim millennial culture. A visit to Qatar is a must for a safe journey, allowing you to explore the captivating desert scenery, modern architecture, and stunning mosques at ease.

We suggest using an online insurance comparison tool to find the best option for your travel preferences, which partners with leading insurance companies.

In this text, we will provide further information about the location and outline the itinerary in order to offer you the optimal experience with a special discount coupon.

In this article, you will find:

- What is the most secure way to travel to Qatar?

- What is the price of a safe journey to Qatar?

- Coupon for discounted safe travel

- Is it compulsory to travel safely to Qatar?

- Why invest in a safe journey to Qatar?

- What does the travel insurance to Qatar include?

- How safe travel operates

- How to initiate secure travel

- Types of travel insurance – what are they?

- What type of travel insurance is needed for Qatar?

- How to ensure secure transportation when traveling to Qatar

- Does Qatar provide coverage for coronavirus during travel?

- Top Insurance Companies in Qatar

- Qatar’s mobile chip technology

- Qatari accommodations

- Commonly Asked Questions

What is the most secure way to travel to Qatar?

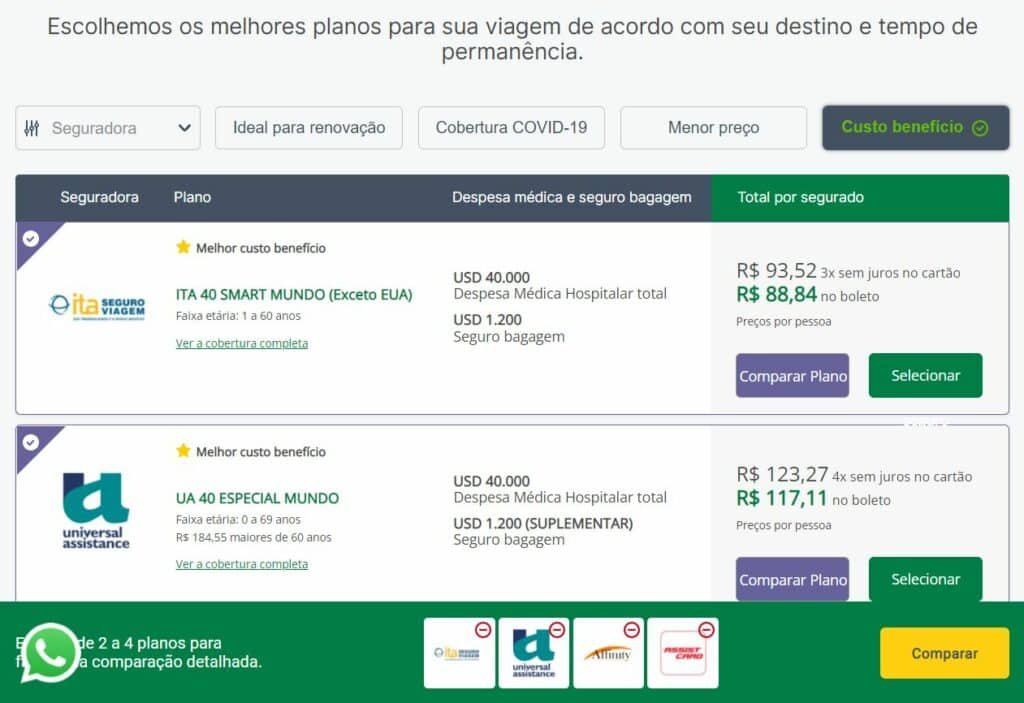

The top travel insurance options for trips to Qatar are the ITA 40 Smart World, UA 40 Special World, and Affinity 60 Inter Promotional. These plans offer excellent medical coverage and round-the-clock service.

The insurance mentioned also includes medical transportation, health repatriation, assistance for lost documents, directions to the nearest medical facility, and disability coverage.

There are numerous choices available, but it is crucial to find one that matches your travel preferences. Explore further information about the chosen options and a comparison table below.

ITA 40 Smart World is the text’s title.

$40,000 coverage for medical-hospital expenses along with $1,200 baggage insurance is provided. Additionally, it includes coverage for sports, dental emergencies, medical transfer, physiotherapy, and pharmaceutical refunds. – VIEW PRICING

UA 40 Special World

Coverage includes $40,000 for medical-hospital expenses, $1,200 for baggage insurance, as well as coverage for sports, dental emergencies, telemedicine, assistance for pregnant women, guidance for lost documents, and pharmaceutical refunds. Check prices for more information.

Affinity 60 Inter Promotion

Medical-hospital expenses coverage of $60,000 along with $800 baggage insurance is provided, as well as coverage for sports, dental emergencies, physiotherapy, telemedicine, hosting escorts or family, and pharmaceutical refunds. Pricing details available.

For additional information on top insurance providers, refer below or explore alternative choices on the online comparison tool.

| Insurance | ITA | Universal Assistance | Affinity |

| Plan | ITA 40 Smart World | UA 40 Special World | Affinity 60 Inter Promotion |

| Medical and hospital expenses | $40,000 | $40,000 | $60,000 |

| Medical cover for sports | $3,500 | Inside the DMH | Inside the DMH |

| Coverage for pregnant women | No | Inside the DMH – Until 28 weeks | Inside the DMH – Until 28 weeks |

| Dental cover | $200 | $500 | $400 |

| Pharmaceutical cover | $250 (refund) | $500 (refund) | $400 (refund) |

| Medical expenditure by covid-19 | No | No | No |

| Regression | $10,000 | $20,000 | $30,000 |

| Flight delay costs | No | – | $300 (12 hours) |

| Assistance in the location of extraviated suitcase | Yeah. | Yeah. | No |

| Damage to the bag | $ 100 | $ 100 | No |

| Extraviated baggage insurance | $1,200 | $1,200 (supply) | $800 (supply) |

| Legal assistance by traffic accident | $500 | $1,200 | $1,000 |

| Insurance value | $ 14,70 (per day) | R$19.80 (per day) | $ 26,90 (per day) |

How expensive is it to ensure a safe journey to Qatar?

You can book a secure journey to Qatar for as low as R$ 14.70 per day. Utilize the online insurance comparison tool to view the various options.

The insurance amount can differ based on the individual booking the service or the activities planned for the trip. For instance, older individuals and those engaging in extreme sports may have slightly higher insurance costs.

The insurance is typically affordable and provides significant value by offering peace of mind during a trip, reducing concerns about handling emergencies as the insurance will handle everything for you.

Everyone purchases insurance for peace of mind, hoping they never have to use it. However, having this support can be beneficial in times of crisis.

Explore the secure travel choices available in Qatar.

Coupon offering a discount for secure travel

chsyys/Pexels

It is more beneficial to purchase insurance for emergencies during the trip at a competitive price. Readers of Travel Tips can utilize the coupon DICASDEVIAGE5 to receive a 5% discount on the total cost. Sounds great, right?

There is an additional 5% discount available for customers who pay with boleto, pix, or bank transfer, and these discounts can be combined. This means you can save up to 10% on your Qatar travel insurance. Additionally, insurance purchases can be paid in installments of up to 12 times for added convenience.

- Redeem the coupon code DICASDEVIAGE5 for a 5% discount.

- Earn an additional 5% discount and save up to 10% by paying through boleto, Pix, or bank transfer.

Is it necessary to travel safely to Qatar?

A mandatory requirement for a safe journey to Qatar is having fully paid health insurance for visitors. It is advised to have a chosen plan with a minimum of $30,000 medical coverage. Failure to provide insurance upon arrival at immigration will result in being denied entry to the country.

You must install and activate the Ehteraz app upon arriving at the country’s borders, in addition to submitting the required document. The app consolidates health and location data of travelers.

Visitors must complete a registration form, show proof of vaccination, and provide a negative PCR test within 48 hours of departure. Check the Join Sherpa website for the most current requirements.

Having insurance while traveling abroad is advisable for all Brazilians, as it provides protection against legal and financial issues, as well as specialized care and increased security during trips, even when not mandatory.

At the conclusion of the trip, the insurance cost is significantly less than potential costs from unexpected situations. A sudden medical appointment could cost up to R $ 500, which is one-fifth of the plan’s value. It is advisable to seek the most suitable insurance for your journey.

Explore the secure travel choices available in Qatar.

Why purchase a safe journey to Qatar?

Securing a travel insurance for your trip to Qatar is essential for two main reasons. Firstly, it is a requirement for entry into the country. Secondly, having insurance coverage ensures assistance in various situations, providing peace of mind during your vacation.

The rural area experiences high temperatures, even with air-conditioned spaces available. The unfamiliar currency and language further contribute to the differences.

Having the peace of mind that you can count on an insurance provider who speaks Portuguese and has additional costs already taken care of is greatly beneficial during stressful times.

We are all vulnerable to accidents and issues with our luggage while traveling. Insurance covers these unexpected events at a reasonable cost compared to the overall trip expenses. It is a worthwhile investment.

Explore the secure travel choices available in Qatar.

What does the travel insurance to Qatar include?

Travel insurance typically includes coverage for certain things like medical emergencies, hospital visits, and lost luggage. However, the extent of coverage can differ depending on the insurance provider and the specific plan selected.

You can ensure safe travel and legal support by hiring travel assistance services for any traffic issues you may encounter. The level of coverage provided will vary based on the insurance plan you select.

The most frequent situations covered by safe travel include:

- Medical, hospital, or dental services available 24/7 during overseas trips

- Repatriation refers to the act of returning someone to their own country.

- Medical transportation

- Transfer of the body and insurance for death during travel.

- Accidental total disability while traveling

- Legal and financial aid

- The passing or severe sickness of a relative

You can also rent additional protective covers for a secure journey.

- Assistance for Covid-19 and global disease outbreaks

- Travel cancellation policy

- Accidental early departure

- Baggage expenses for lost or damaged items

- Accidents during extreme sports

- Delay in flight

- Expecting a baby

Explore the secure travel choices available in Qatar.

How safe traveling operates

Travel insurance ensures travelers receive medical care while abroad and offers support for various situations, including legal issues, through assistance or reimbursement.

The support options provided by the online comparison tool offer direct assistance during emergencies. This means that you can reach out to the insurance company for guidance on necessary actions, such as going to the hospital, without incurring additional costs as the insurance covers all expenses.

Insurance by reimbursement directs you to directly see a healthcare provider, such as a doctor or dentist, and then submit receipts and invoices to get refunded for the expenses. This method is commonly used with secure credit card travel insurance.

Explore all the secure travel choices in Qatar.

How to initiate secure journeys

You can contact your insurance company’s phone number for free from anywhere in the world to ensure safe travel. The service is available in Portuguese, and some insurers offer mobile apps for easier communication.

Always make sure to have your policy number and personal information ready. Inform the representative about your issue, and they will provide the assistance needed to address the situation. Remain calm to comprehend the guidance and resolve the situation effectively.

Carefully reviewing the travel insurance policy and comprehending the specifics of the plan you purchased is crucial. Seek assistance if you encounter any challenges in communicating with the insurance provider, as receiving the necessary support is essential. Subsequently, reach out to the company to address any financial matters.

Explore all the secure transportation choices available in Qatar.

Types of travel insurance include various options.

There are various types of insurance available for different travel preferences. Explore our detailed guides for more information on each type.

- Insurance for traveling abroad

- National travel insurance

- Pregnant individuals can travel safely.

- Sea cruise for safe traveling.

- Safe multiple journeys

- Safe travel to multiple destinations

- Annual travel insurance

- Long-term insurance

- Travel exchange that is secure

- Student Travel Insurance

Explore all the secure travel choices available in Qatar.

What type of travel insurance is needed for Qatar?

A helpful tip for discovering the safest travel options in Qatar is to utilize an online travel insurance comparison tool. Various choices are accessible on the website, and we will provide guidance to assist you in selecting the most suitable plan.

Place the names of the cities you plan to visit at the pencil’s tip. Then, shift your focus to planning and considering all the potential details of the trip.

- What activities do you plan to engage in?

- Do extreme sports like surfing, skydiving, and diving play a role in the plan?

- Are you currently pregnant or could you potentially be expecting a child?

- Is it possible that the trip might be cancelled for any reason?

- Do you need insurance in case your luggage goes missing?

- Some plans provide coverage for individuals who are elderly, up to the age of 70.

- Is your journey going to be lengthy?

- Will you be returning it?

After conducting this evaluation, compare the plans of each insurance company and assess the coverage amounts for each category. The online comparison tool allows you to compare up to 4 plans simultaneously and also showcases the most cost-effective options.

Explore all the secure travel choices available in Qatar.

How to ensure secure transportation to Qatar

Hiring travel insurance in Qatar is easy and can be done online. Promo Insurance is a highly recommended insurance comparison website that provides detailed information on the top plans available in the market to assist you in your decision-making process.

Choose the desired continent on the homepage, enter the departure and arrival dates, provide your name, email, and phone number, then click on “search safe travel”.

You will be guided to a list showing the insurance options for your destination. To compare, select two to four plans and click on “compare plane.” Then, press the “compare” button at the bottom right corner of the screen. This way, you can view the benefits of each insurance plan next to each other to help you make a decision and complete the purchase.

After being hired, you will receive your travel insurance policy by email. It is important to keep this document safe as it contains the terms and conditions of the selected plan and details on how to contact the insurer in case of an emergency.

If there is a chance during the journey, you can reach out to the insurance provider by phone, WhatsApp, online chat, or email. All contact details are listed in the policy document for your convenience.

All insurance companies featured in Promo Insurance offer round-the-clock customer service in Portuguese, ensuring convenience and ease of access regardless of your location.

Explore all the secure travel choices available in Qatar.

Does Qatar provide coverage for coronavirus for safe travel?

Some travel insurance policies do provide coverage for medical expenses related to Covid-19, but not all of them do.

To make sure your travel insurance covers COVID diagnosis overseas, choose plans that explicitly mention this. Check the insurance product title for this information. Review the policy thoroughly and clarify any questions before purchasing.

To find a secure travel insurance plan that includes coverage for Covid-19, it is recommended to compare insurance options online. This allows you to easily compare deductibles offered by different insurers and select the one that best suits your needs.

Top Insurance Companies in Qatar.

When looking for safe travel options to Qatar, many people often wonder which insurance company to choose. With numerous companies available, we offer a guide on the leading ones to assist you in finding the best plan.

Explore our articles to discover details about the background of each insurance company, the available plans, and their reputation on Reclame Here.

- Affinity

- Card for watching

- Coris Safe Travel

- Trip Observation

- Ensure a secure journey.

- Grand Theft Auto

- Intermac Support

- Vital Card

- ITA Travel

- Travel Assistance

- Universal Support

- Travel Assistance by me

Qatar’s mobile chip.

Purchase the mobile chip or eSim from Qatar for a great price to stay connected while in Qatar. Explore the offers from America Chip for unlimited internet access, and use our discount coupon for even better deals.

Qatari accommodations

Another crucial aspect of planning, in addition to ensuring safe travel to Qatar, is arranging accommodation. If you haven’t reserved your lodging yet, consider looking at the Qatar hotel choices we have curated.

- Al Najada Doha Hotel by Tivoli is available for daily stays starting at $92, with a rating of 9.0.

- Swiss-Belinn Doha is available daily starting at $62, receiving a rating of 8.9.

- Sapphire Plaza Hotel is available daily starting from $56 and has a rating of 8.5.

- Kingsgate Hotel in Doha by Millennium Hotels starts at $63 per day and has a rating of 8.4.

Explore all accommodation choices in Qatar.

Frequently Asked Inquiries

International travel insurance provides medical and hospital support overseas in case of accidents or emergencies, as well as legal and luggage coverage, among other benefits. Learn more about secure travel arrangements.

The most affordable travel insurance option for Qatar is the ITA 40 Smart World, which offers plans starting at R$ 14.70 per day. Explore the available plans for more information.

A secure trip to Qatar is essential for traveling there, as the required document must be presented for entry to avoid deportation.

Travelers visiting Qatar are required to have insurance; failing to comply may result in deportation. It is essential for all visitors to the country to be aware of the importance of travel insurance in Qatar.

The comprehensive Qatar travel insurance includes coverage for medical and hospital costs, dental care, repatriation of remains, medical evacuation, and additional customizable features. Explore the available options for more information on the plans.

The safe journey insurance does not apply to accidents caused by travelers under the influence of alcohol or drugs, carrying weapons, or behaving recklessly. It is important to be familiar with the policy rules to ensure you are covered by insurance. Find additional details for clarification.

You can cancel a booked trip by reaching out to the insurance provider at least two days before the scheduled departure. Requests made beyond this timeframe will not be accepted. For further details, please review the terms.

To cancel your travel insurance, get in touch with the insurance provider and ask for cancellation at least two days before the plan expires (departure date). Once this deadline passes, canceling the travel insurance is no longer an option. Find out additional information about Qatar travel insurance.

Travel insurance policies vary by provider. Some policies offer the option to extend coverage for additional time at the destination by requesting a new policy. Look for travel insurance plans that include this feature.

To prolong your secure journey, you should get in touch with the insurance provider to request an extension of the coverage plan. The extension request must be submitted at least two days prior to the policy’s expiration date and is contingent upon the insurer’s approval. Check for available continuous coverage options in the plans.

The cost of a secure journey to Qatar is affordable, with the most popular option priced at approximately R$ 14.70 per day. Explore further details.

You have the option to pay for additional benefits such as coverage for canceled trips, early returns, flight delays, extreme sports, and baggage damage or loss within travel insurance plans.

To travel to Qatar, you must book a safe journey to the country, complete a health and location form as well as a visitor registration form at least three days prior to your trip, show proof of Covid-19 vaccination and a negative PCR test taken within 48 hours before departure. For the latest details, visit the Join Sherpa website. Explore further about Qatar travel insurance.

The recommended travel insurance for the 2022 FIFA World Cup in Qatar is the ITA 40 Smart World. It provides extensive coverage for medical and hospital costs with great value for money. Find out more about the available plans.